According to consulting firm Frost & Sullivan Frost & Sullivan (hereinafter referred to as “Frost”), tire pressure sensors will be the fastest growing product in the automotive parts market.

Ms. Bhar, Frost’s global Automotive and Transportation Parts sector analyst, believes that the demand for automotive tire pressure monitoring systems (TPMS) will triple by 2018 to 2020. On the one hand, the old TPMS system, installed under the U.S. Auto Safety Act since 2007, needs to be updated to avoid failure. On the other hand, European legislation on mandatory installation of TPMS in vehicles sold in the EU27 has come into force. Frost expects the total market value of TPMS to grow rapidly from US $121.1 million in 2013 to US $365.5 million in 2020, a compound annual growth rate of 17%.

North American and European markets are growing fast

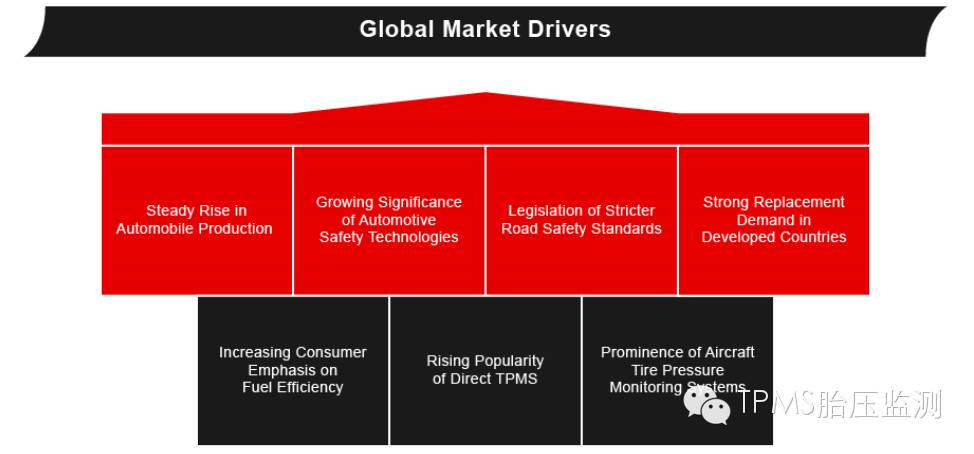

The replacement of old TPMS sensor batteries is expected to be a key driver of the TPMS market in North America. In Europe, the biggest factor affecting TPMS sales is tire sales. According to Frost, shipments of TPMS in North America increased to 7.8 million in 2014, while in Europe they increased to 1.4 million. In addition, the continuous growth of the automotive market also provides a stable growth basis for the TPMS market. In addition to the above reasons, consumers’ emphasis on fuel efficiency (reducing efficiency when tire pressure is insufficient, increasing fuel volume), and the demonstration and leading role of aircraft tire pressure detection systems in technology are also driving the development of automotive TPMS.

However, it should be noted that the extension of sensor battery life may curb the demand in the market. According to Frost’s report, after the U.S. auto safety regulations mandated the installation of TPMS in 2007, the batteries of the first-generation TPMS sensor system began to fail after seven to eight years, and a new system was needed. However, on some TPMS platforms, these sensor batteries can last longer than 10 years. This may delay the replacement of older TPMS equipment, thus making TMPS sales from 2015 to 2020 less than expected. Frost also expects Europe to grow faster than North America, where the market is now more mature. A large number of vehicles with TPMS installed directly will enter the market, driving both TPMS shipments and sales growth. In 2013, the manufacturing unit price of TPMS equipment in North America was about $18, while in Europe it was about $26. As demand increases and more programmable and general-purpose sensors become available, the price of TPMS will continue to decline in the coming years.

Market expansion and mergers will accelerate

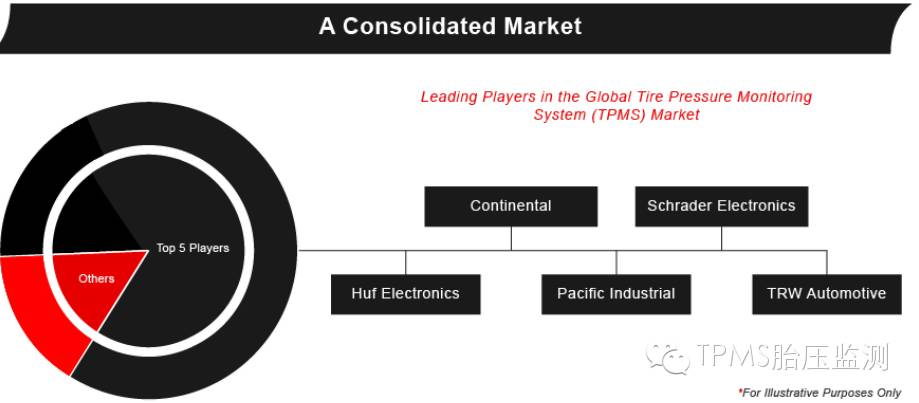

With the increase in the frequency of parts replacement, more and more tire shops, wholesalers, retailers will provide TPMS sensor services. Frost predicts that independent auto repair companies will provide more TPMS services than other outlets. The TPMS market is becoming increasingly competitive, and it is expected that TPMS manufacturers will integrate with each other to achieve economies of scale and accelerate the development process. Netherlands-based sensor and controller manufacturer Sensata, for example, acquired Schrader in August 2014. The combined company is estimated to have 55% of the TPMS market share. In addition to Schrader, the major players in this market are Continental, Huf Electronics, Pacific Industrial and TRW Automotive. They are the leading manufacturer of “Direct” TPMS systems (TPMS systems with pressure sensors built into tires; In contrast, the “indirect” TPMS is the indirect TPMS, which realizes the tire pressure detection function by detecting the speed difference between tires, without pressure sensor – editor’s note), and provides products to the original automobile manufacturers and commercial application manufacturers.

Faced with the impending expansion of the market, the TPMS industry is expected to experience new mergers and acquisitions. While more and more car manufacturers will compete with “indirect” TPMS (tyres without pressure sensors, see note above), direct TPMS manufacturers will still account for 75% of the market in Europe and 84% in North America. “To achieve this high growth, installers must convince consumers to replace their sensors when they expire. The replacement of the sensor is most likely to occur when changing a tyre, “Ms Barr said. “Manufacturers, distributors and installers should work together to educate consumers about the safety benefits of TPMS.”

Post time: Sep-14-2024